What Is a Ledger?

In accounting, a ledger is the complete, detailed record of all financial transactions carried out by a business, arranged by account. Think of it as the master book where all financial activities are systematically logged, categorized, and totaled. Ledgers are used to track the flow of money, monitor the company’s financial health, and prepare official financial reports.

Each ledger is divided into separate accounts such as:

- Assets (e.g., Cash, Accounts Receivable)

- Liabilities (e.g., Loans Payable, Accounts Payable)

- Equity (e.g., Owner’s Capital, Retained Earnings)

- Revenue (e.g., Sales Income, Service Revenue)

- Expenses (e.g., Rent Expense, Salaries Expense)

A ledger provides transparency and ensures that the business can produce accurate financial statements like the Balance Sheet and Income Statement.

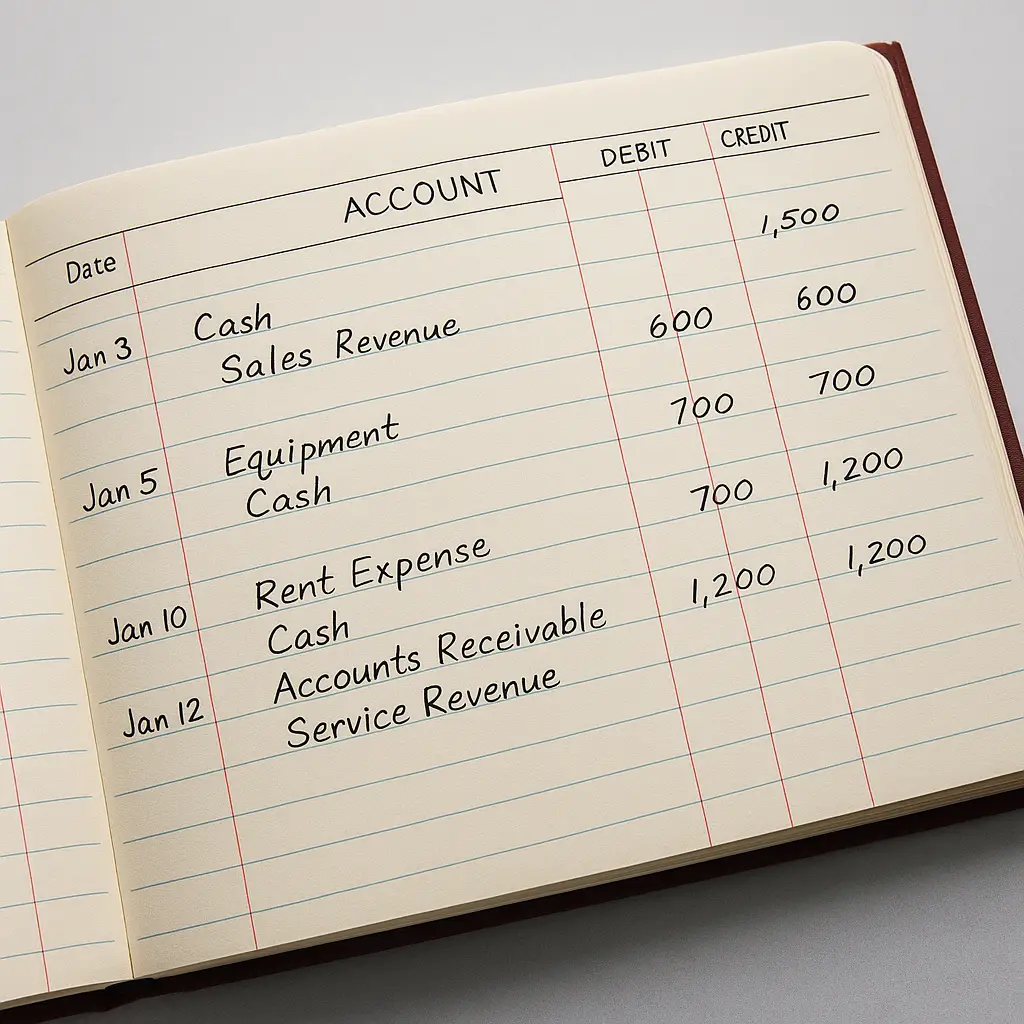

What Is an Entry?

An entry in accounting refers to the recording of a financial transaction in the ledger. Each entry captures the essence of a business event and its monetary impact.

Components of a standard accounting entry include:

- Date of the transaction

- Account(s) involved (e.g., Cash, Revenue)

- Amounts debited and credited

- Brief description or memo (e.g., “Sale of goods to Customer A”)

Every time a transaction occurs, whether it is a purchase, a sale, a payment, or an adjustment, an entry is made to document the movement of money or value.

Why Double-Entry Accounting Is Needed

Double-entry accounting is the gold standard because it ensures the accuracy and reliability of financial records by maintaining the balance of the fundamental accounting equation:

Assets = Liabilities + Owner’s Equity

Key principles of double-entry accounting:

- Every transaction involves at least two accounts.

- Debits must always equal credits.

Why it’s critical:

- Accuracy: It ensures no transaction is recorded only once, reducing the risk of mistakes.

- Financial Integrity: It maintains the logical relationship between assets, liabilities, and equity.

- Error Detection: Discrepancies show up more easily, making fraud and bookkeeping errors easier to spot.

- Professional Standards: It’s the method required by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Example: When a company receives $5,000 in revenue:

- Debit: Cash (Asset increases)

- Credit: Revenue (Income increases)

Both sides are balanced, confirming the integrity of the accounting system.

Types of Ledger Entries and Examples

Here are the main types of entries you will find in an accounting ledger, with more detailed examples:

- Cash Transactions

These involve the immediate receipt or payment of cash.

Example 1: Cash Sale

- Debit: Cash $500

- Credit: Sales Revenue $500

Example 2: Cash Payment for Office Supplies

- Debit: Office Supplies Expense $100

- Credit: Cash $100

- Accounts Receivable Transactions

Recording sales made on credit where cash is collected later.

Example 1: Sale on Credit to Customer

- Debit: Accounts Receivable $1,200

- Credit: Sales Revenue $1,200

Example 2: Customer Payment Received

- Debit: Cash $1,200

- Credit: Accounts Receivable $1,200

- Accounts Payable Transactions

Transactions related to purchases made on credit, to be paid in the future.

Example 1: Buying Office Equipment on Credit

- Debit: Office Equipment $2,500

- Credit: Accounts Payable $2,500

Example 2: Paying a Vendor

- Debit: Accounts Payable $2,500

- Credit: Cash $2,500

- Payroll Transactions

Capturing employee salaries and related deductions.

Example 1: Recording Employee Salaries

- Debit: Salaries Expense $5,000

- Credit: Cash (or Wages Payable if not yet paid) $5,000

Example 2: Employer’s Payroll Tax Expense

- Debit: Payroll Tax Expense $500

- Credit: Payroll Taxes Payable $500

- Asset Transactions

Purchasing or selling long-term assets like equipment, buildings, or vehicles.

Example 1: Buying a Delivery Van

- Debit: Vehicles $20,000

- Credit: Cash $20,000

Example 2: Depreciating Equipment

- Debit: Depreciation Expense $2,000

- Credit: Accumulated Depreciation $2,000

- Loan or Debt Transactions

Borrowing funds or repaying obligations.

Example 1: Taking Out a Bank Loan

- Debit: Cash $50,000

- Credit: Notes Payable $50,000

Example 2: Loan Repayment (Principal Portion)

- Debit: Notes Payable $2,000

- Credit: Cash $2,000

Example 3: Loan Repayment (Interest Portion)

- Debit: Interest Expense $200

- Credit: Cash $200

- Owner’s Equity Transactions

Reflecting contributions or withdrawals by the business owner.

Example 1: Owner Investment

- Debit: Cash $10,000

- Credit: Owner’s Capital $10,000

Example 2: Owner Withdrawal

- Debit: Owner’s Drawings $2,000

- Credit: Cash $2,000

Conclusion

Maintaining a detailed ledger and properly recording every entry is the cornerstone of reliable accounting. The double-entry system ensures that all aspects of a transaction are accurately captured, providing a transparent and comprehensive view of a business’s financial health. Understanding the types of entries and practicing correct double-entry bookkeeping not only ensures compliance but also empowers business owners and financial professionals to make better, informed decisions.

Some of the links on this site are affiliate links. If you click on them and make a purchase, I may earn a commission at no additional cost to you.

As an Amazon Associate I earn from qualifying purchases.