What Are Financial Statements?

Financial statements are official records that present the financial activities and condition of a business in a structured, easy-to-understand format.

They are the foundation of business reporting and help business owners, investors, lenders, and other stakeholders evaluate a company’s financial performance, strength, and direction. They show:

- How much money is coming in, it is being spent.

- What the company owns (assets) and owes (liabilities).

- How much value (equity) the business has built up.

Without accurate financial statements, businesses would be navigating blind — unable to make informed decisions, secure funding, or meet legal and tax requirements.

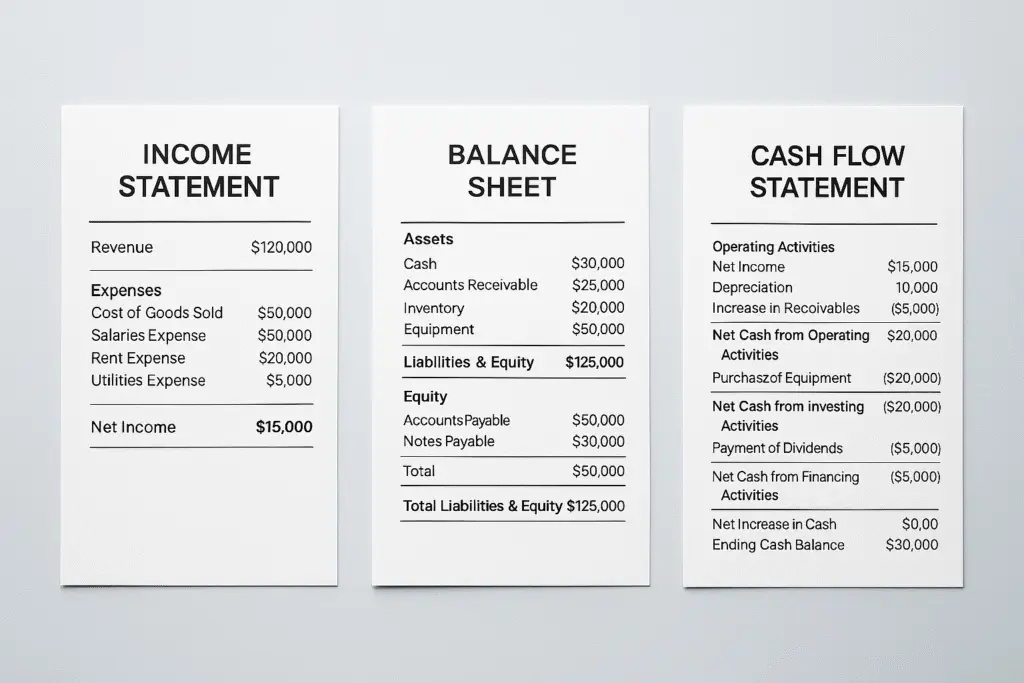

Financial statements typically include three major reports:

The Balance Sheet, The Income Statement, and The Cash Flow Statement. Each report provides different insights, but together they create a complete picture of a company’s financial health.

1. Balance Sheet

Snapshot of Financial Position)

The balance sheet shows a company’s assets, liabilities, and owner’s equity at a specific point in time.

It answers the question: “What do we own and what do we owe?”

Key Sections:

- Assets: What the business owns (cash, accounts receivable, inventory, equipment).

- Liabilities: What the business owes (loans, accounts payable, credit lines).

- Equity: The owner’s remaining interest in the business after liabilities are paid.

Example:

| Assets | Liabilities + Equity |

| $50,000 | $30,000 Liabilities + $20,000 Equity |

Formula:

Assets = Liabilities + Owner’s Equity

2. Income Statement

(Profit and Loss Over Time)

The income statement — also known as the Profit and Loss (P&L) statement — shows the business’s revenues and expenses over a specific period (month, quarter, or year).

It answers: “Is the business making a profit?”

Key Sections:

- Revenue: Money earned from selling products or services.

- Expenses: Costs associated with running the business.

- Net Profit (or Loss): What remains after subtracting expenses from revenue.

Example:

| Revenue | Expenses | Net Profit |

| $100,000 | $80,000 | $20,000 |

Simple Formula:

Revenue – Expenses = Net Profit

3. Cash Flow Statement

(Tracking Cash Inflows and Outflows)

While an income statement shows profitability, the cash flow statement shows real-time cash movement in and out of the business.

It answers: “Are we managing our cash effectively?”

Sections:

- Operating Activities: Cash earned or spent from core business operations.

- Investing Activities: Cash spent on or earned from investments in assets (like buying equipment).

- Financing Activities: Cash raised through loans, investments, or repaid debts.

Example:

| Activity | Cash In (+) | Cash Out (-) |

| Operating | $25,000 | $15,000 |

| Investing | $0 | $5,000 |

| Financing | $10,000 | $0 |

Why Are Financial Statements Important?

- 📊 Track Financial Health: Regular reviews show if the business is growing, stable, or in trouble.

- 📈 Plan and Budget Accurately: Helps in making smart business plans and setting achievable goals.

- 💸 Secure Loans and Investment: Lenders and investors rely on your statements to decide on funding.

- 🧾 Simplify Tax Preparation: Organized finances mean faster, smoother tax filings.

- 🔍 Spot Issues Early: Quickly identify and correct cash flow issues or spending problems.

Final Thoughts

Financial statements are not just for accountants — they are powerful tools for every business owner.

Understanding these essential reports gives you the power to make smart financial decisions, spot opportunities for growth, and avoid costly mistakes.

At MyLedgerSource, we aim to simplify bookkeeping and accounting so you can focus on what you do best — running and growing your business.

Some of the links on this site are affiliate links. If you click on them and make a purchase, I may earn a commission at no additional cost to you.

As an Amazon Associate I earn from qualifying purchases.